TAX MAP

ဒီနေ့မှာတော့ အခွန်ရုံးအတွက် မြေပုံတွေ အကြောင်းလေး မျှဝေပေးချင်ပါတယ်။ Every Realtor must know the term 1SFQFT or 1 Square feet Price which calculate tax based on a One feet by One feet square land price. The price of that one square feet varied depending on several factors.

တစ်ပေပတ်လည် မြေဈေး (ta-bae paet lei myay ze) translates to "1 Square feet of land" in Burmese.

This concept is definitely relevant when discussing land value and property taxes in Myanmar. However, it's important to understand that land tax isn't directly calculated based on a single price per square foot.

Here's a breakdown of how land tax is typically determined in Myanmar:

Three Main Systems: There are three main methods used in different regions to establish the base value of your property for tax purposes: Unit Area Value (UAV), Capital Value, and Annual Rental Value (ARV).

Unit Area Value (UAV): This is the closest concept to "price per square foot." The government pre-determines a UAV for your location, considering factors like property type, age, and amenities. They multiply this UAV by your property's total area to get a base value.

Other Systems: Capital Value uses a percentage of the estimated market value, while ARV estimates potential annual rent as the base value.

Finding Land Prices:

UAV Rates: Unfortunately, there isn't a readily available public source for all UAV rates across Myanmar. You might need to contact your local government offices or a registered land broker to inquire about the specific UAV for your desired area.

Market Research: For a more general idea of land prices in a specific area, you can look at real estate listings or consult with a real estate agent. They can provide insights into recent sales and current market trends.

Additional Tips:

Property Tax Rates: Remember, the UAV or base value is just one factor. The tax rate applied to this base value determines your final property tax amount. This rate can vary depending on your location and property type.

Professional Help: Consulting with a tax advisor or registered land broker familiar with your area can be helpful for navigating land tax calculations and understanding current land market values.

In Myanmar, the cost per square foot for tax purposes is often determined by the tax officer based on a combination of factors, including the **construction cost**, **current market rates**, and **guidelines provided by local authorities**. The **Central Public Works Department (CPWD)** provides indices and plinth area rates that can be used as a reference for calculating construction costs². Additionally, the **capital value** of the property is considered, which is multiplied by the **current property tax rate** and adjusted for the **user category** to calculate the property tax³.

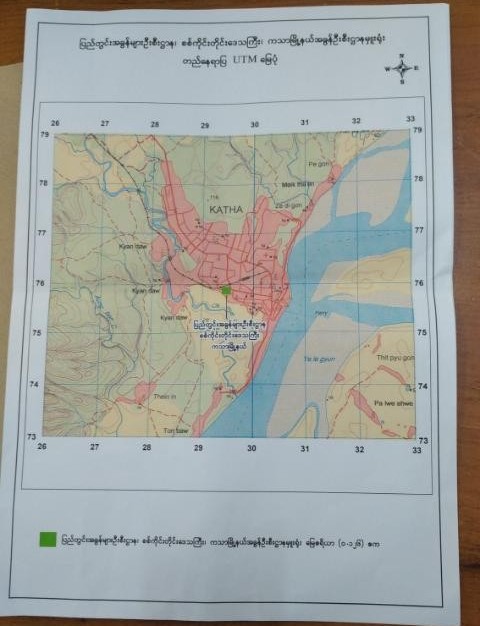

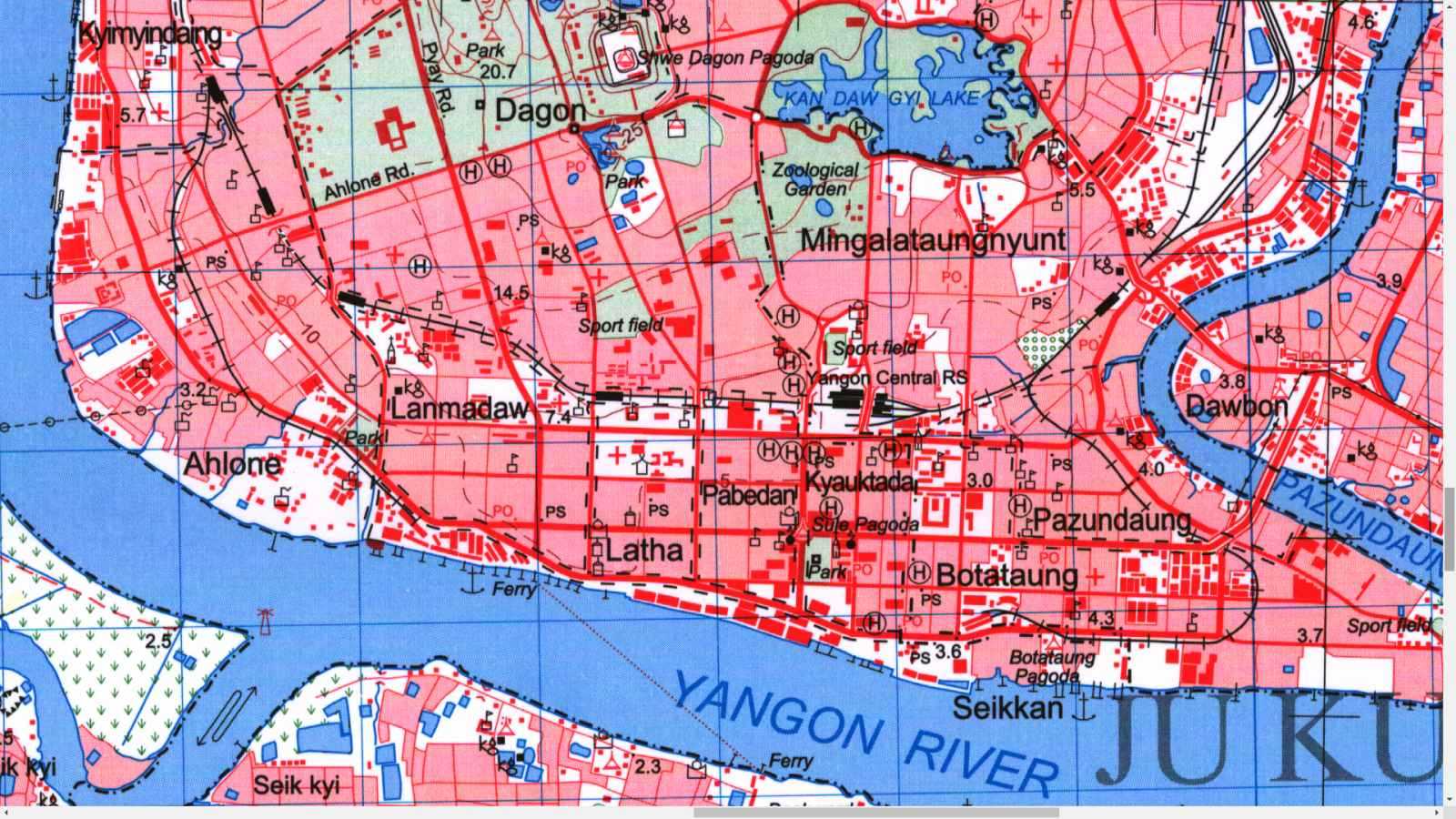

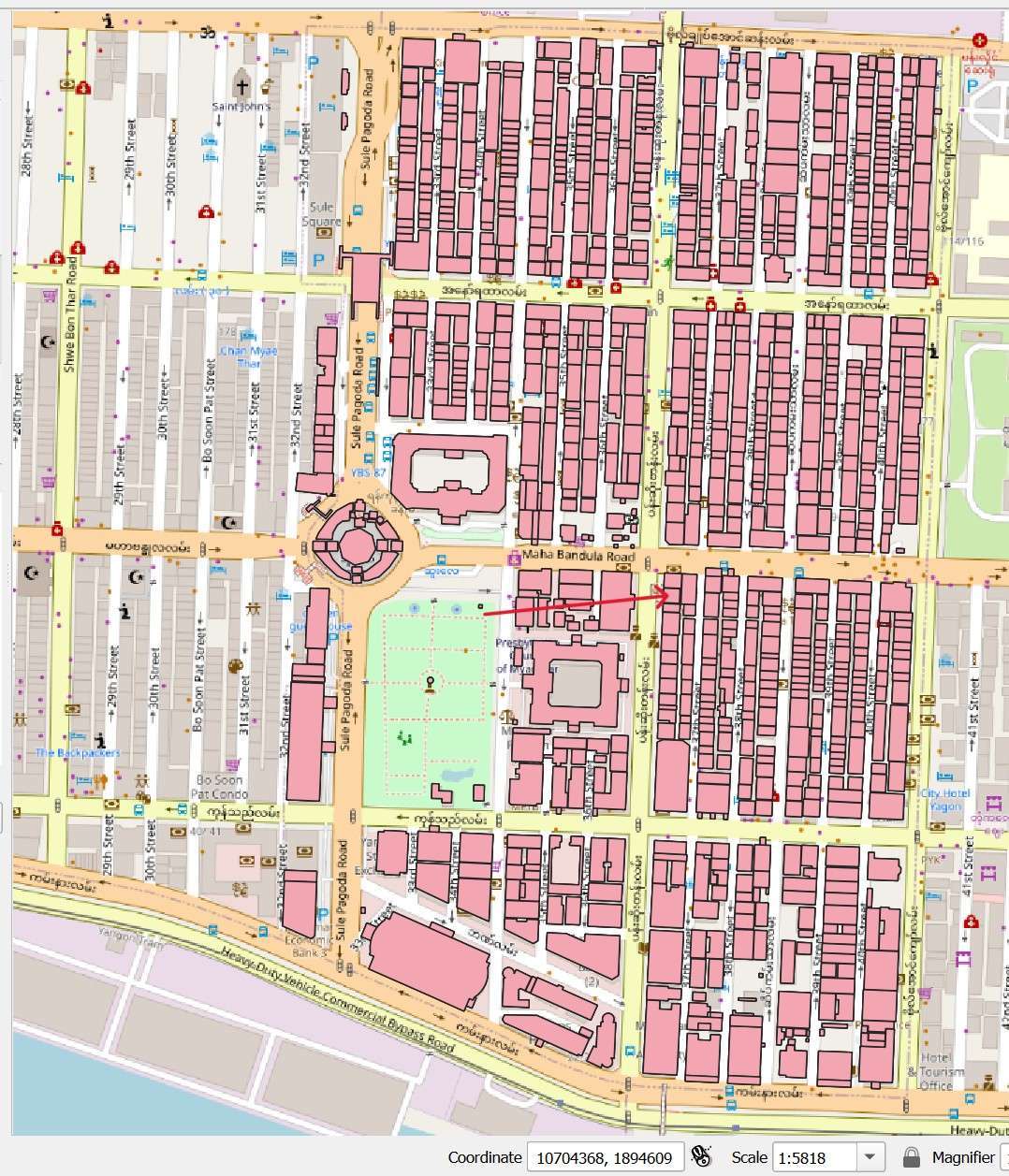

Example of 1SqFt Map : https://dpsmap.com/1sqft

$$

\text{Cost per Square Foot} = \frac{\text{Capital Value of Property}}{\text{Total Square Feet}}

$$

For example, if the capital value of a property is 500,0 Lakh and the total area is 1,000 sq. ft., the cost per square foot would be:

$$

\text{Cost per Square Foot} = \frac{Lakh5,00,0}{1,000 \text{ sq. ft.}} = Lakh5.00 \text{ per sq. ft.}

$$

Please note that this is a general approach and the actual method may vary based on local regulations and specific circumstances. It's advisable to consult with a local tax assessor or a real estate professional for accurate calculations and current rates.

Bing, 3/25/2024

The price per square foot for land tax isn't directly decided, but rather it's a factor used in calculating your overall property tax bill. There are actually three main methods used across different regions to determine the base value of your property for tax purposes:

Unit Area Value (UAV) System: This is the method where a price per square foot is predetermined by the government for your specific location. This price considers factors like property type, age, location, and amenities. They then multiply this per square foot value by your property's total area (built-up area in some cases) to arrive at a base value.

Capital Value System: Here, the government assigns a percentage of your property's market value as the base value for taxation. This market value is estimated by them based on factors like locality and recent sales of similar properties.

Annual Rental Value (ARV) System: This method estimates the potential annual rent your property could generate if leased out. Local authorities determine this ARV based on factors like size, location, and current market rates. The ARV then becomes the base value for your property tax calculation.

So, depending on your location, the government might use the unit area value (UAV) assigned to your area to calculate your land tax. This UAV considers factors like location and expected returns from the property, essentially reflecting the value per square foot.

It's important to note that the tax rate is then applied to this base value to arrive at your final property tax amount. The tax rate can vary depending on your jurisdiction and property type.